Does Homeowners Insurance Cover Mold Removal?

Yes and no. Whether or not mold removal is covered by your homeowners’ insurance depends on the cause of the mold and the specifics of your insurance policy. In most cases, insurance will cover mold removal if the mold was caused by a covered peril, such as a sudden plumbing leak, storm damage, or an appliance malfunction. However, if the mold is due to neglect or poor maintenance, such as long-term water damage, it is unlikely to be covered.

For more detailed information on what homeowners insurance typically covers, check out the Insurance Information Institute’s guide to mold and insurance.

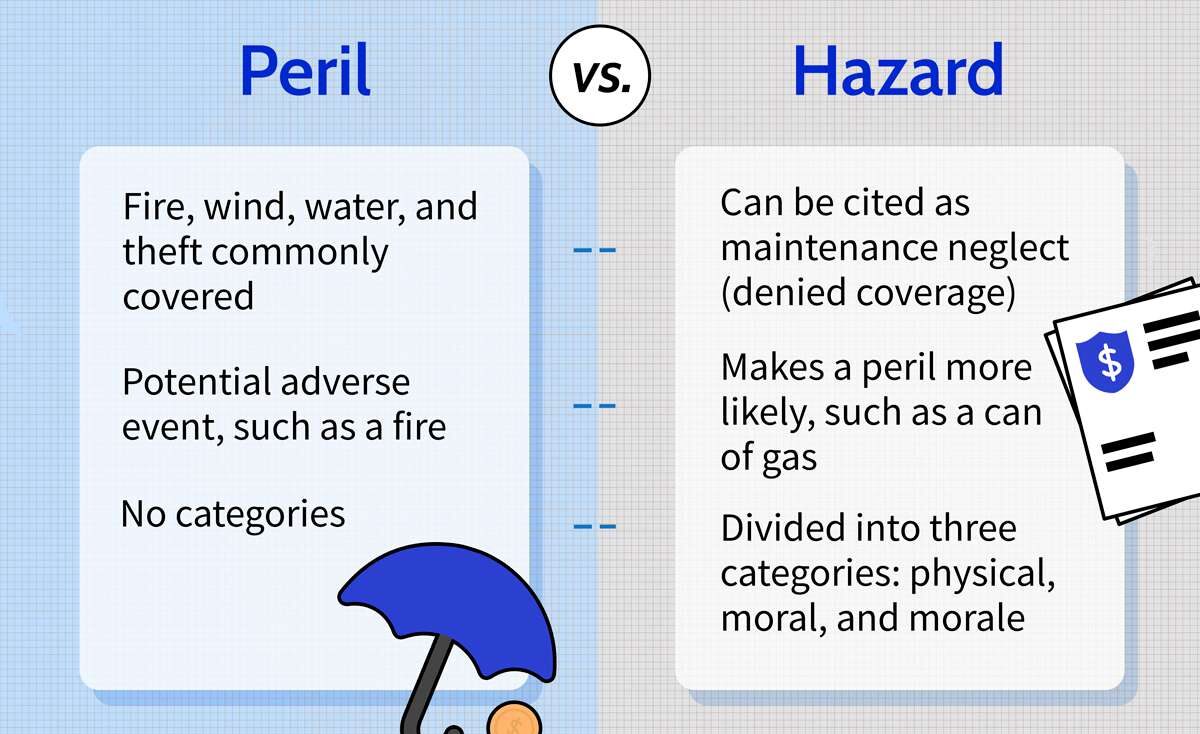

What Is a ‘Covered Peril’ in Homeowners Insurance?

Insurance companies refer to certain types of events as “covered perils.” These are specific incidents or risks that your homeowners’ insurance policy will protect against. When it comes to mold removal, insurance coverage generally applies if the mold growth resulted from one of these covered perils:

1. Sudden and Accidental Water Damage

If mold forms as a result of sudden and accidental water damage—such as a burst pipe, a washing machine malfunction, or a storm that causes roof damage—your homeowners’ insurance will likely cover the mold removal, provided you act quickly to mitigate the damage. In these cases, mold is seen as a consequence of the original damage, which is covered under the policy.

2. Fire Suppression Efforts

In some cases, mold can develop after fire suppression efforts, especially if large amounts of water were used to extinguish the fire. If your policy covers fire damage, it may also cover the resulting mold remediation as part of the restoration process.

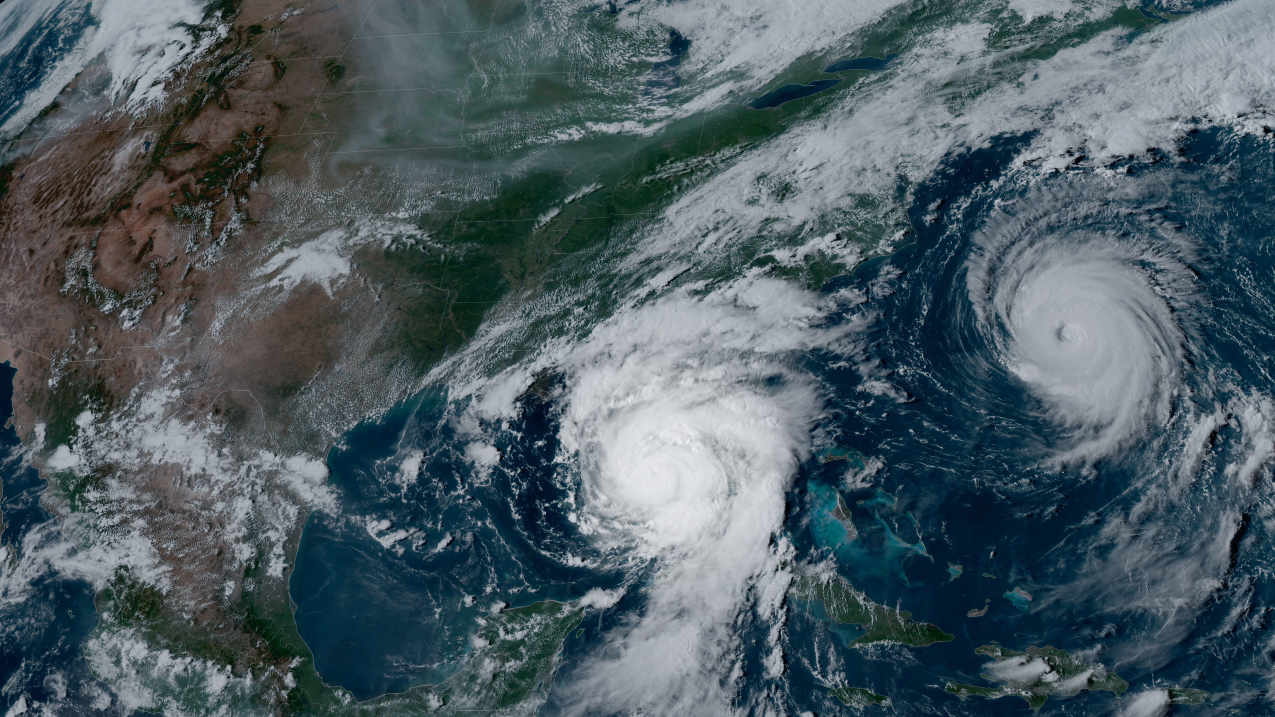

3. Storm or Hail Damage

If mold develops as a result of storm or hail damage (for example, if rain enters your home through a damaged roof or window), your homeowners’ insurance may cover the mold remediation along with repairs to the affected structure.

For more examples of covered perils, refer to this PolicyGenius guide on covered perils in home insurance.

When Is Mold Removal NOT Covered by Insurance?

Insurance does not cover mold removal in all circumstances. If the mold growth was caused by an event or condition that is excluded from your policy, the cost of removing the mold will not be covered. Common exclusions include:

1. Maintenance-Related Issues

If the mold growth resulted from neglected maintenance or poor home upkeep, it is not likely to be covered. This includes situations like long-term plumbing leaks, roof leaks that have been ignored, or areas with persistent moisture problems that haven’t been addressed. Insurance companies expect homeowners to maintain their homes and address minor issues before they become major problems.

2. Flooding

Standard homeowners’ insurance policies do not cover flood damage, which means any mold growth resulting from flooding will also not be covered. If you live in a flood-prone area, it’s essential to have separate flood insurance. This insurance can help cover mold removal and repairs caused by flood-related water damage.

3. High-Humidity Areas

If mold develops in areas with high humidity, such as basements, crawl spaces, or attics, and there was no specific event (like a pipe burst) that caused the moisture, your insurance company may not cover the mold remediation. Mold caused by poor ventilation or high humidity is considered preventable through proper home maintenance.

How Much Does Insurance Cover for Mold Removal?

Even when mold removal is covered by insurance, many policies have limits on how much they will pay for mold remediation. Coverage caps for mold removal typically range from $1,000 to $10,000, depending on your policy. In some cases, you may be able to purchase additional mold coverage or a mold endorsement to increase the coverage limits, especially if you live in a high-risk area for water damage.

Check your insurance policy for specific limits on mold coverage and consider speaking with your insurance provider about adding more coverage if needed.

Steps to Take If You Discover Mold in Your Home

If you discover mold in your home, it’s important to act quickly to prevent further damage and ensure that any insurance claims you file are valid. Here’s what to do:

| Step | Description |

|---|---|

| 1. Document the Damage | Take photos and videos of the mold damage, as well as any evidence of the cause (e.g., water damage from a leaking pipe). This documentation will be essential when filing a claim with your insurance company. |

| 2. Contact Your Insurance Company | Notify your insurance company as soon as possible after discovering mold. They will provide guidance on how to proceed and whether the mold removal will be covered under your policy. |

| 3. Hire a Mold Remediation Specialist | Once your insurance company approves the claim, hire a professional mold remediation company like Citywide Mold Mitigation to assess the extent of the damage and begin the removal process. |

| 4. Prevent Future Mold Growth | After the mold has been removed, take steps to prevent future mold growth, such as fixing leaks, improving ventilation, and using dehumidifiers in damp areas of your home. |

How to Prevent Mold Growth in Your Home

The best way to avoid costly mold removal and insurance claims is to prevent mold from growing in the first place. Here are some tips to keep your home mold-free:

1. Fix Leaks Immediately

Whether it’s a leaky roof, a broken pipe, or a malfunctioning appliance, address any water leaks as soon as you notice them. The longer water sits, the more likely mold is to develop.

2. Control Humidity Levels

Use dehumidifiers in damp areas like basements, bathrooms, and laundry rooms to keep humidity levels below 50%. Mold thrives in moist environments, so keeping your home dry is key to preventing growth.

3. Improve Ventilation

Make sure your home has proper ventilation, especially in areas prone to moisture, such as kitchens and bathrooms. Use exhaust fans to remove excess humidity and improve air circulation.

4. Regularly Inspect Your Home

Conduct regular inspections of your home, particularly in areas where moisture is common, such as under sinks, around windows, and in basements. Catching moisture problems early can help you prevent mold growth before it becomes a major issue.

For more tips on mold prevention, visit the EPA’s guide to mold prevention.

FAQ

| Question | Answer |

|---|---|

| Does homeowners insurance cover mold removal? | Yes, but only if the mold was caused by a covered peril, such as sudden water damage or a burst pipe. Mold caused by poor maintenance or neglect is usually not covered. |

| What are the common exclusions for mold coverage? | Mold removal is typically not covered if the mold results from long-term water damage, high humidity, or flooding. Homeowners are expected to maintain their homes and prevent moisture-related issues. |

| How much will insurance pay for mold remediation? | Most homeowners insurance policies have a limit on how much they will cover for mold removal, usually between $1,000 and $10,000. You may be able to increase this coverage with a mold endorsement. |

| How can I prevent mold from growing in my home? | To prevent mold, fix leaks immediately, use dehumidifiers to control humidity, improve ventilation in damp areas, and conduct regular home inspections to catch moisture problems early. |

| What should I do if I discover mold in my home? | If you discover mold, document the damage, contact your insurance company, and hire a professional mold remediation company like Citywide Mold Mitigation to remove the mold and prevent further growth. |

If you need help with mold remediation or insurance claims, contact Citywide Mold Mitigation today for professional assistance.