Home warranties are marketed as a safety net for homeowners, covering repairs and replacements for essential systems and appliances. However, many people wonder: Are home warranties a scam? While some homeowners find value in these policies, others feel frustrated by denied claims and hidden fees. In this article, we’ll break down the truth behind home warranties, discussing how they work, common complaints, and whether they’re worth the investment.

What Is a Home Warranty?

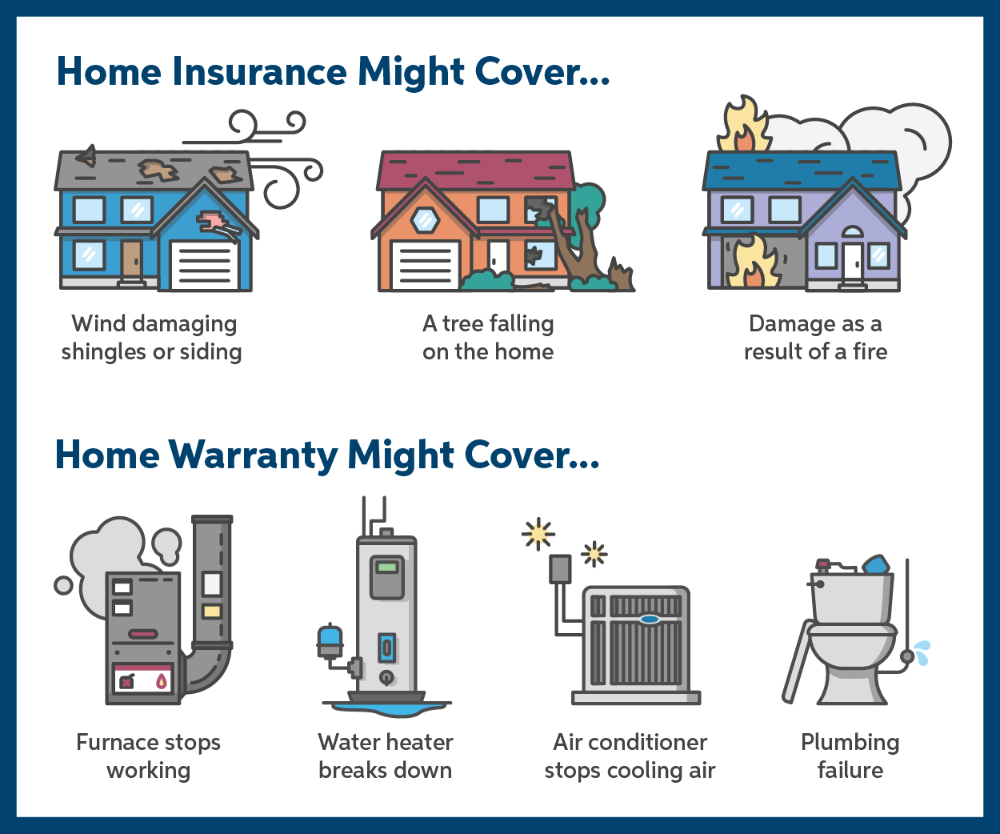

A home warranty is a service contract that covers the cost of repairs and replacements for major home systems and appliances, such as HVAC systems, plumbing, and electrical. Unlike homeowner’s insurance, which covers structural damage and liability, a home warranty is designed to address normal wear and tear on essential home systems and appliances.

Home warranties typically charge an annual premium and require a service fee for each repair visit. While the concept sounds appealing, understanding the limitations and exclusions is crucial to determining if a home warranty is right for you.

How Home Warranties Work

When you purchase a home warranty, you pay an annual premium, which can range from $300 to $600, depending on coverage options. If a covered appliance or system breaks down, you file a claim with the warranty provider. The company then sends a contracted technician to assess the issue. You’ll pay a service fee, usually between $50 and $125, per visit. If the repair is approved, the warranty company covers the remaining cost.

Common Coverage Options

Home warranties often cover:

- Heating, ventilation, and air conditioning (HVAC) systems

- Plumbing systems

- Electrical systems

- Water heaters

- Appliances (refrigerators, dishwashers, washers, dryers, etc.)

What’s Not Covered?

Most home warranties exclude coverage for pre-existing conditions, cosmetic issues, and certain high-end or specialty items. Additionally, some warranties impose caps on repair costs, which can limit coverage.

Are Home Warranties Worth It?

Whether a home warranty is a good investment depends on various factors, including the age of your home, the condition of your appliances, and your personal risk tolerance. Here’s a look at the pros and cons of home warranties:

Pros of Home Warranties

- Peace of Mind: Knowing you have coverage for unexpected breakdowns can reduce stress, especially for first-time homeowners.

- Budget Protection: A home warranty can help manage repair costs for costly systems like HVAC or plumbing.

- Convenience: Warranty providers coordinate repairs, so you don’t have to search for contractors yourself.

Cons of Home Warranties

- Limited Coverage: Many policies have exclusions and coverage caps, meaning you may still be responsible for a portion of repair costs.

- Claim Denials: Some companies deny claims due to “pre-existing conditions” or lack of maintenance, leading to frustration for policyholders.

- Service Fees: You’ll still have to pay a service fee each time you use the warranty, which can add up if repairs are frequent.

Common Complaints About Home Warranties

Home warranties often face criticism, particularly regarding claim denials and hidden fees. Here are some common complaints:

1. Denied Claims Due to “Pre-existing Conditions”

One of the biggest issues with home warranties is claim denial based on pre-existing conditions. Many warranty providers refuse to cover repairs if they determine the issue existed before the policy started. This can be a gray area, as it’s often difficult to prove when a problem began.

2. High Service Fees and Out-of-Pocket Costs

While home warranties cover repairs, you’re still responsible for a service fee with each visit. Additionally, some companies cap repair costs, leaving you to pay the balance if expenses exceed the coverage limit.

3. Limited Choice of Technicians

Home warranty companies usually work with a network of contractors. While this can simplify the repair process, it limits your choice of technician. Some homeowners report dissatisfaction with the quality of work provided by contracted technicians.

4. Poor Customer Service

Customer service is a frequent point of frustration. Many homeowners complain about long wait times, lack of communication, and delays in repairs. A home warranty’s value often depends on the responsiveness and efficiency of its customer service team.

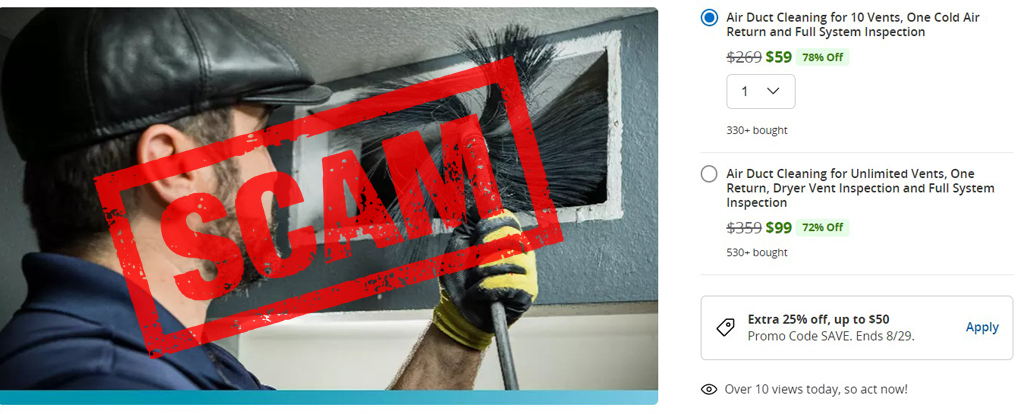

How to Avoid Home Warranty Scams

Not all home warranties are scams, but it’s essential to be vigilant when choosing a provider. Follow these tips to avoid common pitfalls:

1. Read the Fine Print

Carefully review the warranty’s terms and conditions to understand what’s covered, what’s excluded, and any caps on repairs. Knowing the specifics upfront can help you avoid surprises when filing a claim.

2. Research the Company’s Reputation

Look for customer reviews on platforms like the Better Business Bureau and Consumer Reports to gauge the company’s reputation. Companies with high complaint rates or poor ratings may be less reliable.

3. Ask About Claim Denial Rates

Some companies are more likely to deny claims than others. Ask about the provider’s claim denial rates or search for reviews discussing claim experiences. High denial rates may indicate a company that’s more focused on profit than customer satisfaction.

4. Consider Alternatives

If you’re worried about the limitations of a home warranty, consider setting up a personal repair fund instead. Putting aside money each month for home repairs can offer more flexibility without service fees or claim denials.

When Is a Home Warranty Worth It?

A home warranty may be worth it if:

- Your home has older appliances or systems that are prone to breaking down.

- You prefer the convenience of having repairs coordinated by a warranty provider.

- You have a limited emergency fund and want a predictable way to handle repair costs.

However, if you’re handy with repairs or have newer appliances, a home warranty might not offer significant value. Consider the cost of the warranty against the potential out-of-pocket expenses if something breaks.

Conclusion: Are Home Warranties a Scam?

Home warranties aren’t necessarily a scam, but they aren’t always the best choice for every homeowner. Some people find peace of mind and value in a home warranty, while others are left disappointed by denied claims and hidden costs. The key to making a home warranty work for you is understanding the coverage limitations, reading the fine print, and choosing a reputable provider.

If you decide a home warranty isn’t for you, setting up an emergency repair fund can be a smart alternative, providing flexibility without the need for claims or service fees.

FAQ

| Question | Answer |

|---|---|

| What is covered under a home warranty? | Home warranties typically cover major systems like HVAC, plumbing, and electrical, along with appliances like refrigerators, dishwashers, and ovens. |

| Why are home warranty claims often denied? | Claims may be denied due to pre-existing conditions, lack of maintenance, or exclusions in the warranty policy. Always review the terms and conditions before purchasing. |

| How can I avoid a home warranty scam? | Choose a reputable provider, read customer reviews, and review the warranty’s fine print to understand coverage limitations and avoid unexpected costs. |

| Is a home warranty the same as homeowners insurance? | No, homeowners insurance covers structural damage and liability, while a home warranty covers repairs for appliances and home systems due to wear and tear. |

| Can I cancel my home warranty? | Yes, most home warranty providers allow cancellation, though you may be charged a cancellation fee. Check with your provider for their specific cancellation policy and any fees involved. |

If you have more questions about home warranties or alternatives, consider reviewing your options with a financial advisor or setting up a personal repair fund. For home maintenance or mold prevention tips, contact Citywide Mold Mitigation at 844-552-0467 for expert advice.